Don’t panic when you see the latest foreclosure data for NJ

U.S. foreclosure activity has doubled annually but is still below pre-pandemic levels. But where does New Jersey lie when it comes to foreclosures?

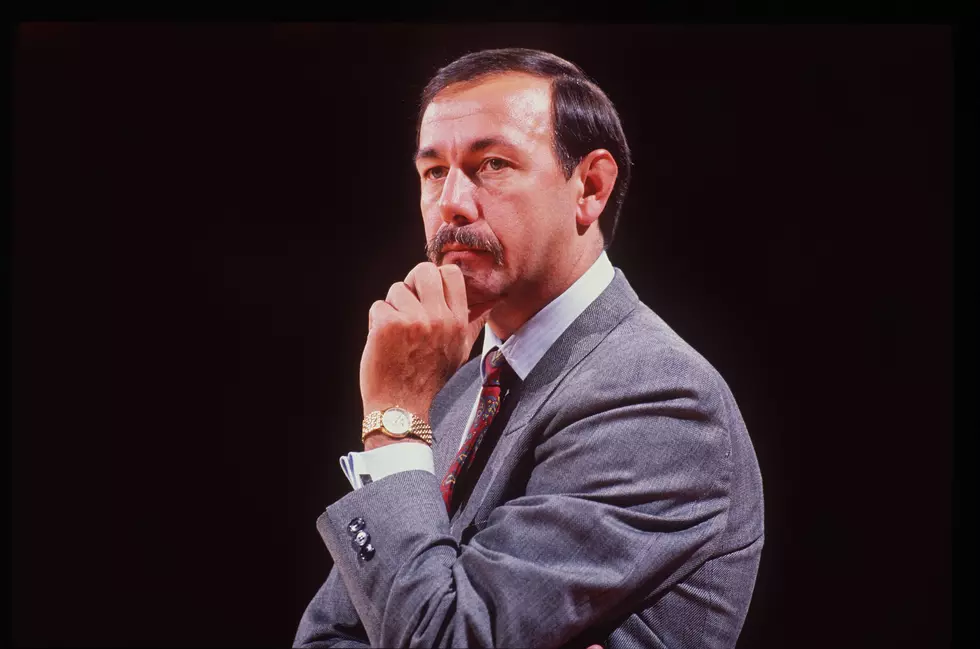

According to Rick Sharga, executive vice president of market intelligence at Attom, a leading curator for real estate data nationwide for land and property data, said nationally about 324,000 households received a foreclosure notice in 2022.

That sounds like a lot of people getting foreclosure notices, but that’s actually running significantly lower than it was prior to the pandemic, and it certainly isn’t any indication of some tsunami of foreclosure problems, Sharga said.

Why is this happening?

The U.S. is coming out of two years of incredible government intervention and very hard work from the mortgage servicing industry to prevent unnecessary defaults, and foreclosures that might have been due strictly to the COVID pandemic, he said.

“Because of that, we’ve had about 8 and a half million borrowers take advantage of government programs to help them through what might have been a tough financial period,” Sharga said.

The government also put a moratorium out on most foreclosure activity for about two years which clearly slowed things down much lower than what would normally be seen in a regular market, he explained.

The industry is gradually working its way back up to more normal levels of foreclosure activity.

Foreclosure activity in an average year represents about 1% of borrowers in the marketplace, he stated. Those borrowers typically fall into some financial difficulty whether it’s job loss, income loss, divorce, unexpected bills, or a death in the family, that prevent them from making mortgage payments on time.

Sharga said once they miss three or four consecutive payments, that triggers the foreclosure process.

The U.S. as a whole did not see a lot of that during the first two years of the pandemic because of the government programs that slowed things down.

But he said now that the programs are expired, those numbers again, are gradually working their way up to those normal levels.

What about New Jersey’s foreclosure rate in 2022?

New Jersey posted one of the highest foreclosure rates in 2022, ranking 2nd overall in the rate of foreclosure activity, Sharga said.

Between 16,000 and 17,000 New Jersey households received a foreclosure notice throughout 2022.

Why is this so?

Sharga said one of the reasons for the high foreclosure rate in New Jersey last year is that it is one of the states that take the longest to process foreclosures. There is a bit of a backlog build-up in the court system as new foreclosures enter the pipeline.

Also keep in mind that before the pandemic, New Jersey also had one of the higher rates in the country of foreclosure activity, and many of those foreclosures were put on hold during the pandemic.

“What we’re seeing in many cases is older loans that were already in trouble, coming through the foreclosure process in New Jersey today. That sort of inflates the numbers a little bit compared to some other states,” Sharga said.

What New Jersey city posted the highest metro foreclosure rate in 2022?

That would be Atlantic City, Sharga said.

Atlantic City didn’t have a huge number of homes in foreclosure in 2022. That number was only 764. But Sharga said relative to the population and the number of housing units there, it effectively was the highest rate of any metro area in the country.

That speaks to local market economies, he said. If there is a booming economy in a marketplace, there will unlikely be a lot of foreclosures. But, if the economy is weaker, like in Atlantic City, foreclosure activity will likely be higher.

What else impacted New Jersey regarding higher foreclosure activity?

It is impacted by two major metropolitan areas: New York City in the north and Philadelphia in the south. Sharga said those two cities have a relatively high number of foreclosures because of their populations, and they also have higher rates of foreclosure activity.

Since New Jersey is part of the metropolitan area of both New York City and Philadelphia, the state’s numbers are often impacted by what’s happening in those two cities, he added.

What was the average foreclosure time in New Jersey in 2022?

The average time to foreclose decreased both quarterly and annually across the nation in 2022. But in New Jersey it took an average of 2,041 days to foreclose, which is not normal, Sharga said.

Judicial states---states that execute foreclosures through the court systems, tend to take longer to begin with, Sharga said.

Before the pandemic, New Jersey timelines were probably somewhere between the 1,000 and 1,200-day cycle, he said.

“What’s happened with all foreclosures across the country is that there’s been a delay of two years due to the government moratorium and we wound up adding about 730 days to every foreclosure proceeding,” Sharga said.

As these government moratoriums expire, Sharga said the average times across the country are starting to come down a bit. He expects to see the same for New Jersey foreclosure numbers, as well.

What is the key takeaway?

In 2022, New Jersey, in general, seemed to close in on pre-pandemic foreclosure levels faster than some other states, Sharga said.

But, it doesn’t indicate a terrible issue with the state’s economy or a terrible weakness in the housing market.

Across the nation, foreclosures are not a big problem. This is not 2008 or the Great Recession, he said. This is just the market making its way back up to normal.

What is the New Jersey forecast for 2023?

“At Attom, we are forecasting that nationally, foreclosure activity probably won’t be back to pre-pandemic levels, 2019 levels, until sometime in the third or fourth quarter of this year. New Jersey levels might get back to 2019 levels a little more quickly than that, but again, we don’t see a huge wave of foreclosures threatening to wipe out the shoreline anytime soon,” Sharga said.

The full report can be found here.

Jen Ursillo is a reporter and anchor for New Jersey 101.5. You can reach her at jennifer.ursillo@townsquaremedia.com

Click here to contact an editor about feedback or a correction for this story.

How much does the average NJ home cost? Median prices by county

More From Rock 104.1